Implats at a glance

Living the Implats Way

Our purpose is to create a better future. We accomplish this through the metals we produce, the way we do business and through our superior performance.

Read moreSouth Africa 0800 005 314

Zimbabwe 0772 161 630

Impala Canada 1-866-921-6714 (toll free) or email the operation at email address:

Impalacanada@integritycounts.ca to lodge complaints or grievances.

For more information on how we handle reports and protect whistleblowers, please review our Fraud, Corruption and Whistleblowing policy

Platinum group metals (PGMs) are used rather than consumed – their high recyclability means they can be re-used many times, reducing their impact on the environment.

Find out more about PGM World

We are proud of our 100 years in platinum mining and we look forward to the continuation of creating innovative solutions.

Discover our rich historyWe are a leading fully integrated platinum group metals (PGMs) producer. The Group is structured around six mining operations, refining and processing facilities, and a refining business, Impala Refining Services (IRS).

Implats employs more than 66 000 people across its operations. Our people are the heartbeat of our Company and through our values – to respect, care and deliver - we foster a culture of teamwork and accountability.

Our products are exported to many sectors in several markets, including Japan, China, the US and Europe, where they are integral to industrial, medical and electronic applications, supporting a cleaner, greener world.

26.29Mt

Tonnes milled from managed operations

3.37Moz

6E sales volumes

R8.1bn

Closing adjusted net cash

165cps

Final dividend declared

59%

Water recycled/re-used

61 000

People benefitted from social performance projects

10 years

Member of the FTSE4Good Index Series

281 539t CO2

Emissions avoided via renewable energy use

Our metals touch lives every day. We are committed to supplying the metals needed to develop, sustain and improve our world.

Bringing long-term growth and opportunity for all our stakeholders

Sustaining industry leading business and financial performance through the commodity cycle

Our vision is to be the most valued and responsible metals producer, creating a better future for our stakeholders

We aspire to deliver value through excellence and execution, adjusting to market dynamics to remain competitive, delivering strong financial returns through commodity cycles

We are committed to responsible stewardship, long-term value creation and being the trusted partner in the way we do business, treat people and limit our environmental impacts

Our value-driven focus is to be a sustainable, high-value and globally competitive integrated metals producer

Our metals, and the way we produce them, improve quality of life - today and for generations to come

Through the positive contribution we make to society, we create lasting benefits for our stakeholders in a way that is respectful, responsible and transparent

At Implats, we respect, care and deliver. The values, beliefs, attitudes and behaviours that we share set us apart and make Implats unique and special.

Our operations are on the Bushveld Complex in South Africa, the Great Dyke in Zimbabwe – the two most significant PGM-bearing ore bodies in the world – and the Canadian Shield.

Click on the mine names below for more information

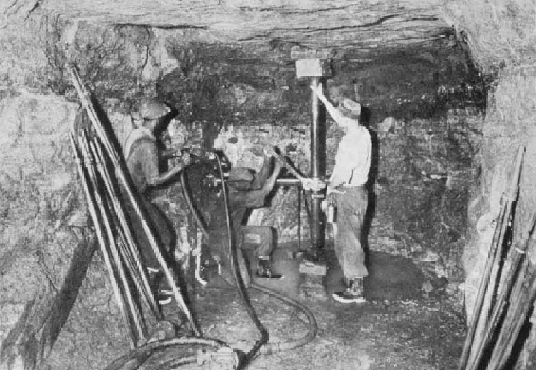

Impala Canada, previously known as North American Palladium, is a wholly owned subsidiary of Implats following its acquisition in late 2019. The Lac des Iles Mine (LDI), Impala Canada’s single operating asset, is located in the Canadian province of Ontario, north of the city of Thunder Bay. The operation comprises underground and surface mining operations and a concentrator. The LDI underground operations employ long-hole open stope and sub‐level shrinkage mining methods.

Impala Bafokeng, previously known as Royal Bafokeng Platinum, is a subsidiary of Implats following its acquisition in 2023. Impala Bafokeng's mining operations are situated on the Western Limb of the Bushveld Complex near Rustenburg in South Africa and are adjacent and contiguous with the Impala Rustenburg mining operations. Impala Bafokeng operates Bafokeng Rasimone Platinum Mine (BRPM) and Styldrift Mine, as well as two concentrators. The Maseve mining operations are under care and maintenance. At BRPM the Merensky and UG2 reefs are mined concurrently using conventional and hybrid mining methods, whereas Styldrift is a mechanised bord and pillar mining operation currently mining only the Merensky reef.

Impala, Implats’ 87%-owned primary subsidiary, has mining operations situated on the Western Limb of the Bushveld Complex near Rustenburg in South Africa. Impala’s base and precious metals refineries are situated in Springs, east of Johannesburg. Impala Refining Services (IRS), a division of Impala, is the dedicated vehicle to house the metal concentrate purchases built up by the Implats Group. IRS also provides smelting and refining services through offtake agreements with Group companies (except Impala) and third parties.

Impala, Implats’ 87%-owned primary subsidiary, has mining operations situated on the Western Limb of the Bushveld Complex near Rustenburg in South Africa. Impala’s base and precious metals refineries are situated in Springs, east of Johannesburg. Impala Refining Services (IRS), a division of Impala, is the dedicated vehicle to house the metal concentrate purchases built up by the Implats Group. IRS also provides smelting and refining services through offtake agreements with Group companies (except Impala) and third parties.

Marula is 73% owned by Implats and is one of the first operations developed on the relatively under-exploited eastern limb of the Bushveld Complex in South Africa. Situated in the Limpopo province, the operation is some 35km north-west of Burgersfort. Marula holds two contiguous mining rights covering 5 494ha across the farms Winaarshoek and Clapham, and portions of the farms Driekop and Forest Hill. Hybrid and conventional mining methods are used.

Two Rivers is a joint venture between African Rainbow Minerals (54%) and Implats (46%). The operation is on the Dwarsrivier farm on the southern part of the eastern limb of the Bushveld Complex, 35km south-west of Burgersfort in Mpumalanga, South Africa. The operation comprises three decline shafts and a concentrator plant and has a life-of-mine offtake agreement with Impala Refining Services (IRS). Underground mining operations are fully mechanised with the bord and pillar mining method employed.

Zimplats is 87% owned by Implats and it is situated on the Zimbabwean Great Dyke, south-west of Harare. Zimplats operates five underground mines and a concentrator at Ngezi. The Selous Metallurgical Complex (SMC), 77km north of the underground operations, comprises a concentrator and a smelter. Zimplats employs mechanised bord and pillar mining to extract ore from stopes.

Mimosa is a 50/50 joint venture between Implats and Sibanye-Stillwater. It is located on the Wedza Geological Complex on the Zimbabwean Great Dyke, 150km east of Bulawayo. The operation comprises a shallow underground mine, accessed by a decline shaft, and a concentrator. Mimosa holds contiguous mining rights over 7 757ha on the North Hill, the South Hill, Mtshingwe Block and Far South Hill orebody areas. Mimosa employs bord and pillar mining methods.

Sustainable development remains at the heart of our strategy and Implats is resolute in progressively enhancing its environmental practices while contributing to socio-economic benefits for all stakeholders.

The PGMs we produce play an important role in the global imperative to achieve net zero. We are progressively reducing and mitigating our environmental impact at our operations and across our value chain, while also investing in developing thriving communities to sustain livelihoods beyond mining.

Implats' key strategic phases at a glance

Use the slider or click the years below for more information.