Climate change

Living the Implats Way

Our purpose is to create a better future. We accomplish this through the metals we produce, the way we do business and through our superior performance.

Read moreSouth Africa 0800 005 314

Zimbabwe 0772 161 630

Impala Canada 1-866-921-6714 (toll free) or email the operation at email address:

Impalacanada@integritycounts.ca to lodge complaints or grievances.

For more information on how we handle reports and protect whistleblowers, please review our Fraud, Corruption and Whistleblowing policy

The Implats board oversees the Group's response to climate change, with executive management responsible for identifying and managing climate-related risks and opportunities. The board delegates some of its authority to board sub-committees.

Read our ASMR and GRI report

We recognise that climate change is a global challenge requiring businesses to reduce GHG emissions across the value chain, and to build operational resilience while ensuring transparent communication and engagement with stakeholders.

Read our latest storiesThe Implats board oversees the Group's response to climate change, with executive management responsible for identifying and managing climate-related risks and opportunities. The board delegates some of its authority to board sub-committees.

| Risk management |

Capital allocation |

Legal and regulatory compliance |

Social and environmental stewardship |

Business development and strategic planning |

|

| Thandi Orleyn |  |

|

|

|

|

|---|---|---|---|---|---|

| Dawn Earp |  |

|

|

|

|

| Ralph Havenstein |  |

|

|

||

| Billy Mawasha |  |

|

|

||

| Mametja Moshe |  |

|

|

|

|

| Sydney Mufamadi |  |

|

|

|

|

| Mpho Nkeli |  |

|

|

|

|

| Preston Speckmann |  |

|

|

|

|

| Bernard Swanepoel |  |

|

|

||

| Boitumelo Koshane |  |

|

|

|

Expertise

Expertise

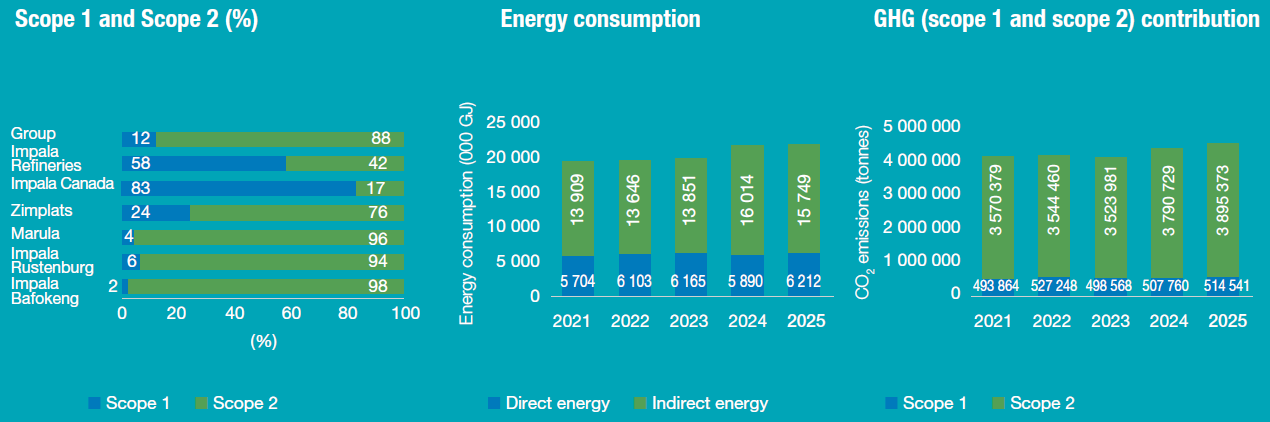

Implats' carbon emissions (combined scope 1 and scope 2 emissions) increased by 2.6% to 4 409 915tCO2 in FY2025 (2024: 4 298 488tCO2). Carbon emission and energy use intensities deteriorated to 0.168tCO2 per tonne milled (2024: 0.154tCO2 per tonne milled) and 0.835GJ per tonne milled (2024: 0.783GJ per tonne milled), respectively, on the back of decreased production (6% year-on-year) and increased energy usage (0.3%), mostly associated with the commissioning of Furnace 2 at Zimplats. The Group's total energy usage was 21 960 350GJ (2024: 21 903 733GJ).

Use the slider or click the years below for more information.

Our five-lever climate change strategy is designed to facilitate the shift away from fossil fuels and reduce GHG emissions to meet our 2050 goal of achieving carbon neutrality.

We commit to transparency and embracing local and global disclosure frameworks in our corporate reporting.

We identify current and future physical risks – acute risks resulting from increased severity of weather events, and chronic risks relating to long-term changes in climate; revise design flood return periods for surface long-term infrastructure; and consider impacts of changes on ambient temperatures.

We have set a long-term goal to be carbon neutral by 2050, with a 2030 target of reducing the carbon intensity of our operations by 30% from a 2019 baseline.

We produce metals that are required for the low-carbon economy. Our focus on efficient, low-cost and low-carbon operations will ensure that Implats remains competitive throughout the shift to a low-carbon economy.

We identify current and future transition risks to those associated with the global shift towards a more sustainable, net-zero economy. These include policy and market, and reputational risks. We mitigate these by keeping abreast of developments and continually adjusting the way we approach our business.

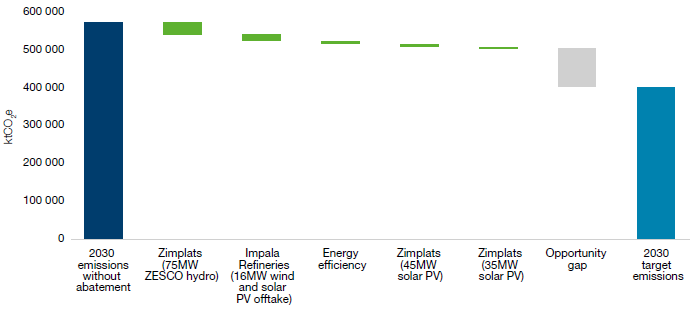

Implats has a publicly stated goal to reduce its GHG emissions at managed operations 30%, off 2019 as a baseline year, by removing approximately 1.7Mt CO2e emissions by 2030, and to reach carbon neutrality by 2050.

Board-approved and implemented decarbonisation projects and projects to close opportunity gap

Implats has concluded a five-year renewable electricity supply agreement (RESA), which will replace up to 90% of Impala Refineries’ electricity use with a combination of solar- and wind-generated electricity starting in Q2 2026. The Impala Refineries RESA does not require upfront capital expenditure — similar to the power purchase agreement established at Zimplats in 2023 for 75MW of hydroelectricity from Zambia (with the possibility to increase this agreement to 90MW).

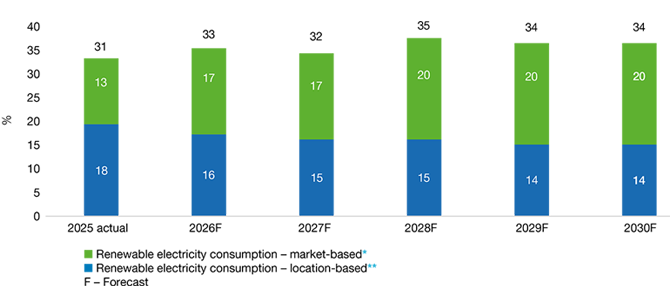

Renewable and non-carbon-based electricity consumption

* Market-based renewable electricity – renewable electricity sourced from own-built facilities or through RESA/power purchase agreements with energy traders.

** Location-based renewable and non-carbon-based electricity – renewable and non-carbon-based electricity (nuclear) supplied from national utility. We expect location-based renewable and non-carbon-based energy mix to gradually increase as our host countries implement their renewable energy transition policies, but have conservatively assumed the mix to remain 17% for South Africa and 50% for Zimbabwe to 2030.

The Group will continue to communicate annually on its decarbonisation progress and its management of climate change-related risks through the Carbon Disclosure Project (CDP). The published 2024 CDP scores, which allow benchmarking versus participating peers, saw Implats rated B for climate. Climate-related risks are continuously monitored for their physical impacts and financial implications on the Group. During the period, we continued to track and manage the following key climate- related risks:

| Risk | Description | Classification | Mitigation actions | Financial implications |

| Extreme weather events |

|

Physical |

|

|

| Failure to establish resilience against water scarcity at southern African operations |

|

Physical |

|

|

| Long-term habitat restoration and rehabilitation |

|

Physical |

|

|

| Inability to meet Group interim decarbonisation target |

|

Transition |

|

|

| Policy and regulatory changes |

|

Transition |

|

|

To achieve our decarbonisation goals we continue to focus on: